wr8.ru

Community

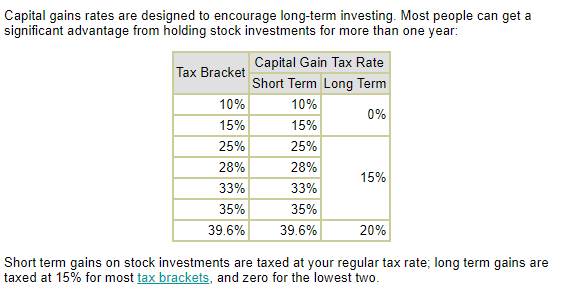

Do I Have To Pay Tax On Stock Gains

A capital gain occurs when you sell an asset for a price higher than its basis. · If you hold an investment for more than a year before selling, your profit is. How does Minnesota tax capital gains income? Minnesota includes all net What are the income levels, filing types, and ages of Minnesota residents who have. Capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income level. You may have to pay Capital Gains Tax if you make a profit ('gain') when you sell (or 'dispose of') shares or other investments. Capital Gains Tax is the tax on investment profits. You may have to pay it if you sell an investment held outside a tax-efficient account such as an ISA. You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than your total cost basis (what. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. Yes. Unless you are investing inside a government sanctioned retirement account, you must pay taxes when gains are “realized”, that is, when. If you held your shares for more than one year before selling them, the profits will be taxed at the lower long-term capital gains rate. Capital Gains Tax. The. A capital gain occurs when you sell an asset for a price higher than its basis. · If you hold an investment for more than a year before selling, your profit is. How does Minnesota tax capital gains income? Minnesota includes all net What are the income levels, filing types, and ages of Minnesota residents who have. Capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income level. You may have to pay Capital Gains Tax if you make a profit ('gain') when you sell (or 'dispose of') shares or other investments. Capital Gains Tax is the tax on investment profits. You may have to pay it if you sell an investment held outside a tax-efficient account such as an ISA. You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than your total cost basis (what. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. Yes. Unless you are investing inside a government sanctioned retirement account, you must pay taxes when gains are “realized”, that is, when. If you held your shares for more than one year before selling them, the profits will be taxed at the lower long-term capital gains rate. Capital Gains Tax. The.

You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. How to report and pay the tax Only individuals owing capital gains tax are required to file a capital gains tax return, along with a copy of their federal tax. Generally, the Investment Income Tax for capital gains is 10%. Argentina (Last New Zealand does not have a comprehensive capital gains tax. However. Bartering is a type of sale involving the exchange of property. Gain from bartering is taxable for Pennsylvania personal income tax purposes. Gain from. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Unrealized, accrued capital gains are generally not considered taxable income. For example, if you bought an asset (e.g. a share of stock) for $ ten years. If it is in a taxable account, you will be taxed on the gain. Short term gain (stock held taxed similar to your regular income. Long. Investment income taxes · Capital gains, dividends, and interest income. Most investment income is taxable. · Net investment income tax (NIIT) · If you owe this. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Capital gains tax is a tax on profits from selling investments like stocks or real estate. It's calculated based on the difference between the purchase and. You won't pay any taxes until you sell the share. Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund. Capital gains are taxed in the taxable year they are "realized." Your capital gain (or loss) is generally realized for tax purposes when you sell a capital. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. Short-term capital gains tax applies when you sell an asset that you owned for less than one year, and that gained in value within that time frame. These gains. Yes. IIRC, it might not be taxed, but it is likely reportable on Form Schedule D. Upvote 2 Downvote Award Share. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. When you. Take full advantage of the 0% long-term capital gains tax bracket. If you have a low enough income in any year to pay 0% on capital gains, you should be selling. Long-term capital gains and qualified dividends are generally taxed at special capital gains tax rates of 0 percent, 15 percent, and 20 percent depending on. No tax would be due on the gain until you sold the asset. A trusted financial advisor may be able to help you reduce the amount of capital gains taxes you. General tax questions. Do I have to file a tax return if I don't owe capital gains tax?